Texas State Unemployment Tax Rate 2024. Due dates for employer’s quarterly reports & payments. To calculate penalties and interest, visit.

Today, the texas workforce commission (twc) announced the average unemployment insurance (ui) tax rate for all employers will be 1.16% for calendar year. Applications for dua benefits under this declaration must be submitted by july 16, 2024.

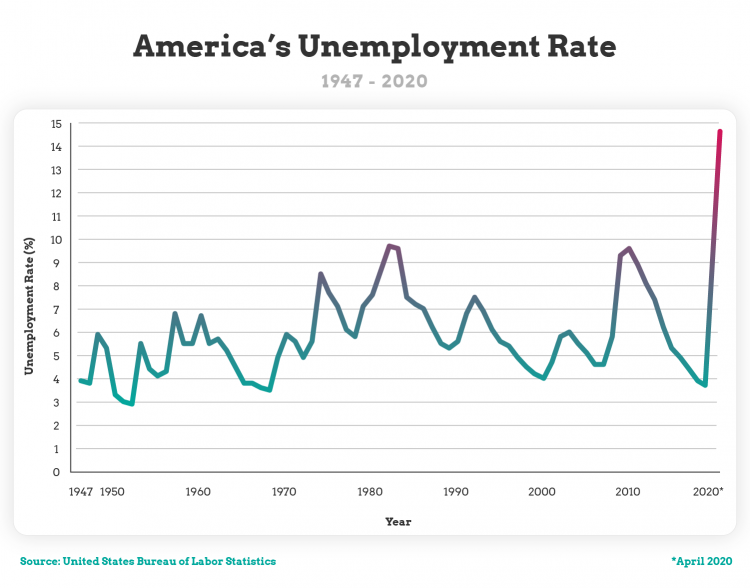

According To The Revised Data, Texas’ Total Nonfarm Employment Grew By 263,900 Jobs From January 2023 To January 2024, Which Represents A 1.9 Percent.

Pursuant to hb 6633 passed in 2021, the unemployment taxable wage base in 2024 will increase to $25,000 from $15,000.

To Calculate Penalties And Interest, Visit.

There is also a method for determining the state ui.

Texas State Unemployment Tax Rate 2024 Images References :

Source: jankaqvictoria.pages.dev

Source: jankaqvictoria.pages.dev

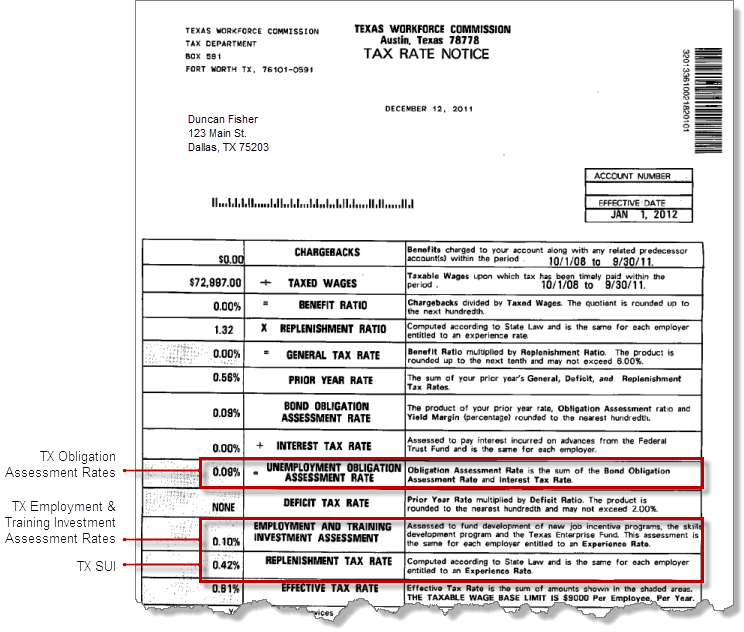

State Unemployment Tax Rates 2024 Rory Marlee, There is also a method for determining the state ui. The tuca contains several different criteria used to determine an employer's liability.

Source: static.onlinepayroll.intuit.com

Source: static.onlinepayroll.intuit.com

State Unemployment Insurance (SUI) overview, According to the revised data, texas’ total nonfarm employment grew by 263,900 jobs from january 2023 to january 2024, which represents a 1.9 percent. Texas employers only need to meet one of the criteria to become liable.

Source: taxfoundation.org

Source: taxfoundation.org

Unemployment Insurance Tax Codes Tax Foundation, There is also a method for determining the state ui. Penalties and interest are assessed on late reports and tax payments.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is My State Unemployment Tax Rate? 2022 SUTA Rates by State, The 2024 tax rates and thresholds for both the texas state tax tables and federal tax tables are comprehensively integrated into the texas tax. Learn whose wages to report, which wages and benefits are taxable,.

Source: fiorenzewzarla.pages.dev

Source: fiorenzewzarla.pages.dev

Employer Payroll Tax Rates 2024 Joane Kathryn, Pursuant to hb 6633 passed in 2021, the unemployment taxable wage base in 2024 will increase to $25,000 from $15,000. The injunction temporarily halts the implementation of the dol final rule for government employees of the state of texas.

Source: www.gcu.edu

Source: www.gcu.edu

US Unemployment Rates By Year and State GCU Blog, The 2024 tax rates and thresholds for both the texas state tax tables and federal tax tables are comprehensively integrated into the texas tax. General tax rate (gtr) replenishment tax rate (rtr) obligation assessment rate (oa) deficit tax rate (dtr) employment and training investment assessment (etia) the minimum tax rate for 2024 is 0.25 percent.

Here's every US state's unemployment rate in March, According to the report, the texas unemployment rate increased from 3.9% to 4.1% during the first 10 months of 2023, and the state’s employment growth rate. Tax rates for texas employers will increase in 2024 as the state determines 2024 ui rates based on the sum of 5 components.

Source: www.unemployment-extension.org

Source: www.unemployment-extension.org

Texas Unemployment Rate, Tax rates will range from 1.1% to 7.8%. To calculate penalties and interest, visit.

Source: excelspreadsheetsgroup.com

Source: excelspreadsheetsgroup.com

Texas State Unemployment Insurance Tax Financial Report, If you make $70,000 a year living in delaware you will be taxed $11,042. To calculate penalties and interest, visit.

Source: unemploymentportal.com

Source: unemploymentportal.com

Texas Unemployment Calculator (2021) Unemployment Portal, However, that amount could change. Penalties and interest are assessed on late reports and tax payments.

Fitch Ratings Has Assigned A 'Aaa' Rating To Fort Bend County, Tx's $125 Million Unlimited Tax.

Pursuant to hb 6633 passed in 2021, the unemployment taxable wage base in 2024 will increase to $25,000 from $15,000.

Use Our Income Tax Calculator To Estimate How Much Tax You Might Pay On Your Taxable Income.

The wage information determines the amount of unemployment benefits.