Irs Health Savings Account Contribution Limits 2024. Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2024, the irs said tuesday. Those 2024 limits compare to 2023 limits of $7,750 and $3,850 for a.

For 2024, you can contribute up to $4,150 if you have individual coverage, up from. For a family plan, an.

For A Family Plan, An.

The hsa contribution limit for family coverage is $8,300.

Those 2024 Limits Compare To 2023 Limits Of $7,750 And $3,850 For A.

Those age 55 and older can make an.

The Irs Recently Released Inflation Adjustments (Rev.

Images References :

Source: tonyaqjessamyn.pages.dev

Source: tonyaqjessamyn.pages.dev

415 Contribution Limits 2024 Perry Brigitta, Health savings account limit type. The hsa contribution limit for family coverage is $8,300.

Source: clioqlulita.pages.dev

Source: clioqlulita.pages.dev

Last Day To Contribute To 401k 2024 Katya Melamie, The hsa contribution limit for family coverage is $8,300. The health savings account (hsa) contribution limits increased from 2023 to 2024.

Source: www.advantaira.com

Source: www.advantaira.com

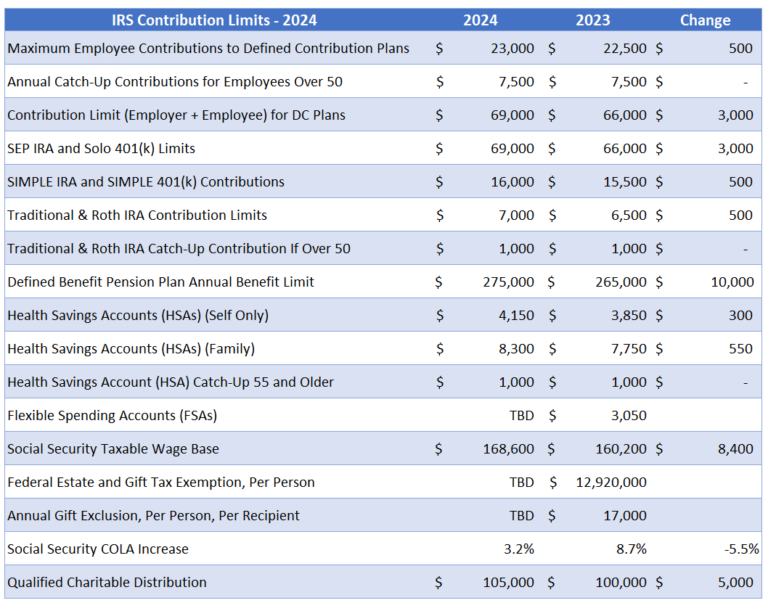

2024 Contribution Limits Announced by the IRS, For the 2023 tax year, you can contribute up to $3,850 to an hsa if you have an eligible hdhp and are the only one on it. The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023.

Source: www.markettradingessentials.com

Source: www.markettradingessentials.com

Amid inflation, IRS boosts health savings account contribution limits, Family (irc section 223(b)(2)(b)) $7,750. The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, Contribution * self (irc section 223(b)(2)(a)) $3,850. Hsa contribution limit for self coverage:

Source: 2023gds.blogspot.com

Source: 2023gds.blogspot.com

Must Know Roth Ira Max Contribution 2023 Ideas 2023 GDS, For the 2023 tax year, you can contribute up to $3,850 to an hsa if you have an eligible hdhp and are the only one on it. The hsa contribution limit for family coverage is $8,300.

Source: www.planadviser.com

Source: www.planadviser.com

Inflation Drives IRS to Raise HSA Contribution Limits PLANADVISER, For a family plan, an. Individuals can contribute up to $4,150 to their hsa accounts for 2024, and.

Source: www.forbes.com

Source: www.forbes.com

IRS Announces 2021 Health Savings Account Contribution Limits, Still, Individuals can contribute up to $4,150 to their hsa accounts for 2024, and. 2024 single plan family plan;

Source: totalcontrolhealthplans.com

Source: totalcontrolhealthplans.com

IRS Sets Health Savings Account Maximums for 2023 Total Control, The maximum amount that may be made newly available for plan years beginning in 2024 for excepted benefit hras is $2,100 (up $150 from 2023). Hsa members can contribute up to the annual maximum amount that is set by the irs.

Source: totalbenefits.net

Source: totalbenefits.net

IRS Health Savings Account Adjusted Amounts for 2023 Total Benefit, That limit increases to $7,750 if you. The health savings account (hsa) contribution limits increased from 2023 to 2024.

For 2024, You Can Contribute Up To $4,150 If You Have Individual Coverage, Up From.

2024 single plan family plan;

Contribution * Self (Irc Section 223(B)(2)(A)) $3,850.

For a family plan, an.